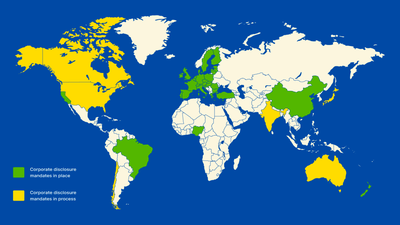

In recent years, Environmental, Social, and Governance (ESG) criteria have become a cornerstone in the landscape of corporate accountability and sustainability. Companies globally are increasingly recognizing the importance of ESG reporting as stakeholders demand transparency regarding their environmental and social impacts. ESG reporting not only addresses investor concerns but also enhances corporate reputation and builds trust with consumers. However, the requirements for corporate climate disclosures vary significantly across countries and regions.

ESG reporting refers to the disclosure of a company's performance and risk management related to environmental, social, and governance criteria. These disclosures provide stakeholders, including investors, employees, customers, and regulators, with insights into how well a company is managing risks and opportunities related to environmental and social sustainability.

The significance of ESG reporting has grown over the past decade due to several factors:

Investor Demand: Institutional investors and asset managers prioritize sustainability in their investment decisions, seeking to understand the long-term risks posed by climate change and other ESG factors.

Regulatory Pressure: Governments and regulatory bodies are increasingly mandating disclosures to ensure businesses contribute to societal goals, such as climate action and social equity.

Reputation and Brand Loyalty: Consumers are more conscious of corporate responsibility, and companies that demonstrate commitment to sustainable practices can enhance their brand loyalty and market position.

Risk Management: By transparently reporting on ESG factors, companies can better identify and mitigate potential risks that could affect their operations and profitability.

Before delving into individual country mandates, it is essential to understand the frameworks and standards that shape ESG reporting globally. Several organizations have developed guidelines and principles for companies to follow:

Global Reporting Initiative (GRI): The GRI Standards are widely used for sustainability reporting and emphasize transparency and accountability in various sustainability aspects.

Sustainability Accounting Standards Board (SASB): SASB provides industry-specific standards for companies to disclose ESG information relevant to financial performance.

Task Force on Climate-related Financial Disclosures (TCFD): TCFD offers a framework for companies to disclose information related to climate change risks and opportunities, helping investors understand their exposure to climate-related risks.

International Integrated Reporting Council (IIRC): The IIRC promotes integrated reporting, which combines financial and non-financial information to provide a holistic view of a company's value creation.

European Union Non-Financial Reporting Directive (EU NFRD): This directive mandates large companies in the EU to disclose certain non-financial information, including ESG factors.

The European Union has been at the forefront of promoting corporate sustainability through comprehensive ESG reporting mandates.

Implemented in 2018, the NFRD requires large public-interest companies with more than 500 employees to disclose non-financial information concerning environmental, social, and governance issues. This includes information on:

In 2021, the EU proposed a revision to the NFRD, known as the Corporate Sustainability Reporting Directive (CSRD), which aims to expand the scope of reporting requirements and include more companies.

Following Brexit, the UK has developed its own regulatory framework for ESG reporting.

Under the Companies Act, large companies are required to include a statement on their environmental impact in their strategic reports. In 2019, the UK government announced plans to enhance corporate disclosures related to climate change, building on guidelines such as TCFD.

The UK government has committed to making TCFD-aligned disclosures mandatory for large companies and financial institutions by 2022. This move aims to improve transparency and risk management concerning climate-related financial risks.

In the United States, ESG reporting is primarily driven by market forces, but regulatory frameworks are evolving.

While the SEC has not instituted mandatory ESG disclosures across the board, it has indicated support for enhanced disclosures on climate-related risks. In 2021, the SEC proposed rules requiring public companies to disclose information on:

Canada has taken significant steps to enhance corporate ESG disclosures.

The CSA has issued guidance encouraging companies to disclose material ESG-related risks, with a focus on climate-related risks.

In 2021, the Canadian government announced its commitment to making TCFD-aligned disclosures mandatory for publicly traded companies by 2024. This aligns with global efforts to standardize climate-related disclosures.

Australia's approach to ESG reporting is evolving, with a focus on transparency and aligning with international frameworks.

The ASX Corporate Governance Council provides guidance for listed entities on reporting sustainability risks, including climate change.

Australia has reinforced its commitment to TCFD principles, with regulatory bodies encouraging companies to disclose their climate-related risks and opportunities.

Japan has made significant strides in ESG reporting, particularly in alignment with international frameworks.

Japan's Stewardship Code encourages institutional investors to engage with companies on ESG issues, while the Corporate Governance Code emphasizes transparency in sustainability reports.

Japan actively supports TCFD and has introduced initiatives to encourage companies to adopt TCFD recommendations in their disclosures.

Several emerging economies are also beginning to implement ESG reporting mandates, albeit at varied paces and levels of sophistication.

In Brazil, the Securities and Exchange Commission (CVM) has adopted regulations that encourage public companies to disclose ESG-related risks, aligning with international frameworks such as TCFD.

India's Securities and Exchange Board (SEBI) has introduced guidelines requiring the top 1,000 listed companies to furnish business responsibility and sustainability reporting, thereby incorporating ESG factors into their disclosures.

South Africa is pioneering ESG reporting through its King Code of Governance Principles, which encourage companies to report on sustainability matters as part of their integrated reporting framework.

The push for standardization in ESG reporting has gained momentum as various countries and sectors recognize the challenges posed by inconsistent reporting practices. Efforts by organizations like SASB and GRI are crucial for creating frameworks that enhance comparability and reliability of disclosures.

Companies are increasingly leveraging technology and reporting tools to facilitate ESG data collection and reporting. Advanced analytics, artificial intelligence, and blockchain are emerging as innovative solutions to enhance the accuracy of disclosures.

Engaging stakeholders throughout the reporting process is becoming a best practice. Companies are recognizing the value of feedback from investors, employees, and communities in shaping their ESG strategies and disclosures.

As ESG reporting matures, companies are increasingly emphasizing materiality in their disclosures, outlining information that is financially relevant and significant to stakeholders.

There is a growing recognition that ESG factors can influence financial performance. Companies are starting to integrate ESG disclosures with financial reporting, providing a comprehensive view of how sustainability impacts business value.

Despite efforts to standardize ESG reporting, the absence of universally accepted standards remains a challenge. Companies may face confusion and inconsistency for stakeholders when interpreting disparate frameworks.

Obtaining accurate and reliable ESG data can be a daunting task. Companies often struggle with data availability, quality, and the capability to track relevant metrics consistently.

The regulatory landscape surrounding ESG reporting is continually evolving, leading to complexities for companies attempting to navigate differing requirements across jurisdictions. This complexity can hinder effective compliance and reporting efforts.

Companies may be reluctant to disclose certain sensitive information that could affect their competitive positioning. Striking the right balance between transparency and protecting proprietary information remains a key concern.

The trend toward heightened regulatory requirements for ESG reporting is likely to continue. Governments and regulatory bodies will further examine the risks posed by climate change and other ESG factors, driving greater transparency.

The global nature of today’s markets necessitates collaboration among countries, standard-setting organizations, and industry players. Joint efforts to harmonize ESG reporting frameworks can enhance the credibility and consistency of disclosures.

As capital markets prioritize sustainability, companies that effectively manage and report their ESG risks may attract greater investment. This emphasis on sustainability will become a competitive differentiator.

With growing public awareness about climate change and social issues, companies will face increasing pressure from consumers and activists to disclose their ESG performance. This external scrutiny will drive companies to adopt more rigorous reporting practices.

The movement toward mandatory ESG reporting is gaining traction globally as regulation, investor pressure, and public demand for corporate accountability converge. Various countries have developed frameworks requiring corporate climate disclosures, resulting in enhanced transparency and commitment to sustainable practices. As companies respond to these mandates, they stand at a critical juncture where responsible governance and stakeholder engagement can elevate their reputations and financial performance.

While challenges remain in standardizing ESG reporting and improving data quality, the future holds promise for a harmonized and effective reporting landscape. As countries continue to refine their approaches to ESG disclosures, the collective effort can lead to meaningful progress in addressing climate change and enhancing corporate responsibility.

In this dynamic landscape, companies that embrace comprehensive ESG reporting will be better positioned to navigate risks, seize opportunities, and contribute to a more sustainable future.